Extension Information

Current Version: v2024-4-16 (release notes)

OpenCart Versions: 1.5.2.x - 4.0.2.x

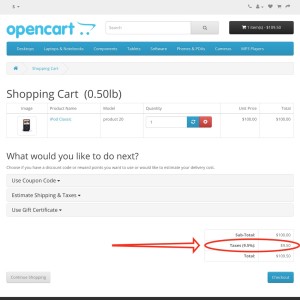

Integrate your OpenCart store with TaxJar.com, an easy-to-use sales tax management service for retailers. This extension connects OpenCart with TaxJar services, including using the customer's address to determine correct tax rate for their location, pulling that tax rate into OpenCart as an Order Total line item, and then submitting the order to be recorded into your TaxJar transaction listings.

- Upload and go — no core file modifications are necessary. The extension utilizes vQmod for OpenCart 1.5.x, ocMod for OpenCart 2.x/3.0, and Event hooks for OpenCart 4.0

- Take advantage of the built-in extension updater. All that's required is to enter your current license key and click "Update".

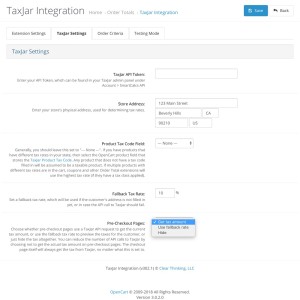

- Set your store's shipping origin address directly through the admin panel. TaxJar uses this, along with the customer's precise location, to accurately determine all state and local taxes that must be paid.

- Enter a fallback tax rate for each geo zone in your installation, in case the request to TaxJar fails.

- Choose whether pre-checkout pages perform API requests to TaxJar, or use the fallback rate you've entered, to reduce the number of API calls to TaxJar.

- Optionally enter variable Product Tax Codes for your products, using any existing product database field (e.g. Location or MPN).

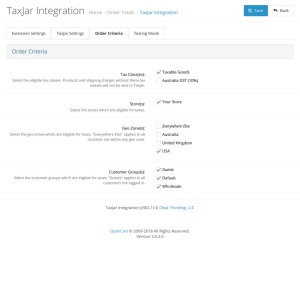

- Charge tax on shipping methods, by making sure they have an eligible tax class applied to them.

- Restrict the extension by store, geo zone, and customer group.

- Automatically pass order information from OpenCart to TaxJar when an order is processed, or manually submit previous or missed orders using the added button visible on orders in the OpenCart admin panel.

- Batch send multiple orders to TaxJar through the extension admin panel.

- View a report of orders that have been sent to TaxJar.

- Includes a Testing Mode so you can see all API requests to and responses from TaxJar, helping to debug things when they don't look right on the front end.